Talk to us

Have questions? Reach out to us directly.

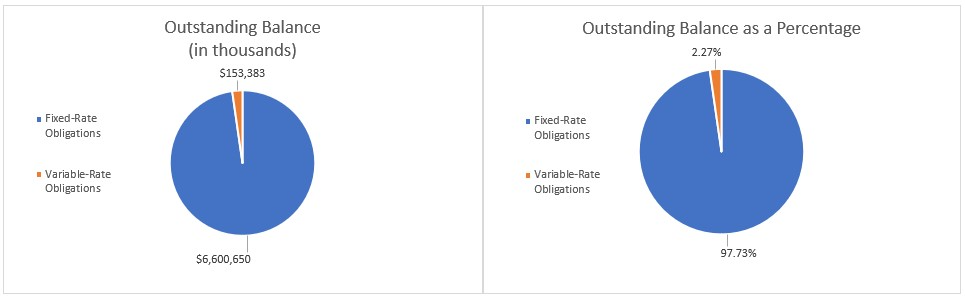

General Obligations:

The Wisconsin Constitution provides that the State may issue general obligations for three categories of borrowing. The first is to acquire, construct, develop, extend, enlarge, or improve land, waters, property, highways, railways, buildings, equipment, or facilities for public purposes. The second is to make funds available for veterans housing loans. The third is to fund or refund any outstanding State general obligations. Subject to constitutional limitations about purposes and amounts, procedures governing the use of the borrowing authority are to be established by the Legislature. There is no constitutional requirement that the issuance of general obligations receive the direct approval of the electorate.

Total Outstanding Balance (12/15/2024) $6,754,033,000

Registrar/Paying Agent:

The Secretary of Administration is the registrar and paying agent for all outstanding fixed-rate general obligations. U.S. Bank National Association serves as issuing and paying agent for the EMCP, and The Bank of New York Mellon Trust Company, N.A. serves as paying agent and tender agent for the VRDO Notes and paying agent for the FRNs.

Security:

The Wisconsin Constitution pledges the full faith, credit, and taxing power of the State to its general obligations and requires the Legislature to provide for their payment by appropriation. The Wisconsin Statutes establish additional protections, provide for the repayment of all general obligations, and establish, as security for the payment of all debt service on general obligations, an irrevocable appropriation as a first charge on all revenues of the State.

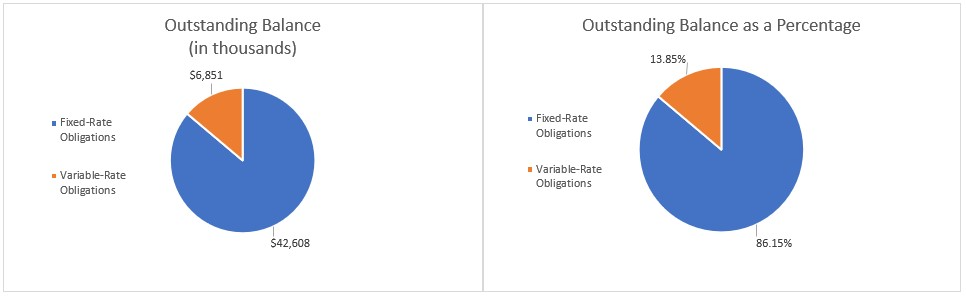

Master Lease Certificates of Participation:

The Program, which was created in 1992 for use by all State agencies, permits the State to acquire tangible property and, in certain situations, intangible property or prepaid service items (Leased Items), for State agencies through installment purchase contracts. Particular Leased Items are described in schedules (Lease Schedules) that are prepared under the Third Amended and Restated Master Lease, dated as of April 28, 2000 (Master Lease), between the Lessor and the State. Through the period ending December 15, 2024, 19 State departments, the Legislature, the Supreme Court, and various other State bodies have used the Program to acquire approximately $822 million of Leased Items.

Total Outstanding Balance (12/15/2024) $49,458,287

Trustee/Paying Agent:

U.S. Bank National Association serves as Trustee, Paying Agent, Registrar, and Lessor.

Security:

The Certificates evidence a proportionate interest in Lease Payments to be made by the State under the Master Lease with regard to equipment items and service contracts.

The Certificates do no constitute debt of the State or any of its subdivisions. The State’s obligation to make Lease Payments is not a general obligation of the State and is not supported by the full faith and credit of the State. The State is not obligated to levy or pledge any tax to make the Lease Payments, but such payments are required from legally available funds, subject to annual appropriation.

Transportation Revenue Obligations:

The State of Wisconsin Building Commission typically adopts Series Resolutions that authorize the issuance of transportation revenue obligations for new money and refunding purposes. This authorization is generally effective for a period of one year from date of adoption. In addition, the Commission has previously adopted, and may in the future adopt, Series Resolutions that authorize the issuance of Transportation Revenue Commercial Paper Notes (Notes) and Bonds to pay for the funding of any Notes; these Series Resolutions have been and may be required pursuant to terms of any credit agreement by which the liquidity facility provider provides a line of credit for liquidity on the Notes, and this authorization is effective for the term of any Notes. The Bonds to refund outstanding Bonds, any Bonds to fund new money purposes, and Bonds to take-out any Notes, when and if issued, are expected to be issued on a parity with the Bonds issued by the State pursuant to the General Resolution.

Total Outstanding Balance (12/15/2024) $1,360,305,000

Trustee/Paying Agent:

The Bank of New York Mellon Trust Company, N.A. serves as Trustee for all obligations, as well as Registrar and Paying Agent for the Bonds.

Security:

The Bonds are secured by a first lien pledge of Program Income, the Funds created by the General Resolution, as amended, and any other income of the Program. Program Income includes vehicle Registration Fees authorized under Section 341.25, Wisconsin Statutes (which is a substantial amount of the Program Income) and certain Other Registration-Related Fees added pursuant to 2003 Wisconsin Act 33 (including, but not limited to, vehicle title transaction fees, registration and title counter service fees, and personalized license plate issuance and renewal fees).

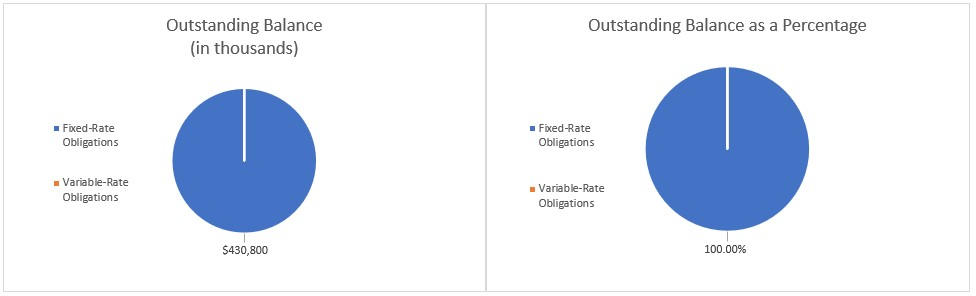

Environmental Improvement Fund Revenue Bonds:

Funds the State’s Environmental Improvement Fund which currently provides for the following separate environmental financing programs:

• Clean Water Fund Program. Established in 1990, the Clean Water Fund Program is a municipal financial assistance program for water pollution control projects and includes the State’s implementation of a Federal SRF Program under the Water Quality Act. Starting in 2015, the issuance of environmental improvement fund revenue bonds replaced the need for issuance of clean water revenue bonds to fund the Clean Water Fund Program.

• Safe Drinking Water Loan Program. The Safe Drinking Water Loan Program is a municipal loan program for drinking water projects and includes the State’s implementation of the federal Safe Drinking Water Act. In 2019, issuance of environmental improvement fund revenue bonds was expanded to provide financing for the Safe Drinking Water Loan Program.

Total Outstanding Balance (12/15/2024) $430,800,000

Trustee/Paying Agent:

U.S. Bank National Association serves as Trustee, Registrar, and Paying Agent.

Security:

The Bonds are payable solely from Pledged Revenues, which include (1) Loan Repayments on Pledged Loans, (2) moneys received by the State upon any default under Municipal Obligations, and (3) any other moneys or revenues pledged in the Program Resolution to secure the Bonds, and from any amounts on deposit in the Loan Fund, Revenue Fund, Redemption Fund, and Supplemental Income Fund.

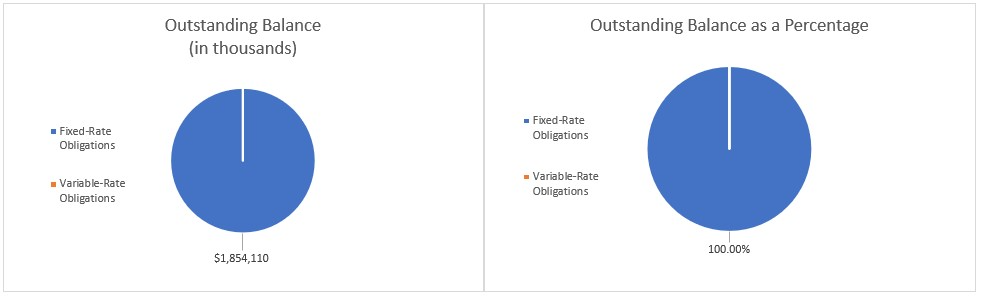

General Fund Annual Appropriation Bonds:

Have been issued:

• To fund the State’s unfunded accrued prior service (pension) liability and the State’s unfunded accrued liability for sick leave conversion, and to refund a portion of obligations previously issued for that purpose.

• To finance the purchase of tobacco settlement revenues that had been previously sold by the State.

Total Outstanding Balance (12/15/2024) $1,854,110,000

Trustee/Paying Agent:

The Bank of New York Mellon Trust Company, N.A. as successor to U.S. Bank National Association.

Security:

The payment of the principal of, and interest on, the Bonds is subject to annual appropriation; that is, payments due in any Fiscal Year of the State will be made only to the extent sufficient amounts are appropriated by the Legislature for that purpose.

The Bonds do not constitute debt of the State or any of its subdivisions. The State’s obligation to make payments of the principal of, and interest on, the Bonds is not a general obligation of the State and is not supported by the full faith and credit of the State.

Talk to us

Have questions? Reach out to us directly.